Facing foreclosure and considering a short sale? Maybe a friend suggested a short sale, so you did a Google search to see what a short sale is.

No worries! This detailed guide will help you navigate the full short sale process and understand everything you need to know about the short sales, including what a short sale is, how it works specifically, how it affects your credit and more.

Then, we’ll outline the most important benefits of a short sale for sellers, buyers, and lenders. Lastly, we’ll provide tips if you would like to short sale your own property.

Let’s get started…

Table of Contents

Contents

- What is a Short Sale?

- Avoiding Foreclosure

- How Does a Short Sale Affect Your Credit?

- When Does a Short Sale Make Sense?

- The Short Sale Process

- How Everyone Benefits from the Short Sale Process

- Frequently Asked Questions

- Foreclosure Scams to Avoid

- Don’t Wait, Things Could Get Worse

- Next Steps and Working With the Right Team

What is a Short Sale?

After the big real estate bubble and credit crisis from 2007-2009 that caused thousands of families to lose their homes to foreclosure, the term short sale became a term nearly everyone knew or heard of.

Even today almost 10 years later, foreclosures and short sales are still happening. But what is a short sale anyways?

Simply put, a Short Sale is when you sell your house for less than you owe your lender and the lender receives the proceeds from the sale to cover what they’re owed.

For example, if you owe $150,000 on your mortgage, and the house is only worth $100,000 in your current market, you are “underwater” by $50,000. If the lender agrees to the short sale, they may discount that $50,000 off the loan entirely for it to be able to sell.

There are 2 main scenarios when a short sale is considered which we’ll cover in more detail later, these are:

- Financial Hardship – This happens when you either can no longer afford to make payments on their loan and are facing hardship.

- Underwater – The home is worth less than the homeowner owes, and there is not enough equity in the home to pay off the mortgage after a sale.

Again, we’ll cover these 2 scenarios in more detail later but these are the main cases when a short sale will make sense and be considered by a bank.

Doing a Short Sale to Avoid Foreclosure

Many homeowners consider doing a short sale to avoid foreclosure.

With foreclosures still in abundance, it makes sense why homeowners consider short sales as a great exit option.

Florida for example, is well-known for being a state with a high rate of foreclosures and short sales. Unfortunate, but true. In fact, on average, 1 in every 1596 homes faces foreclosure in Florida.

So if you’re facing foreclosure, you’re not alone.

How Does a Short Sale Affect Your Credit?

Unfortunately, some homeowners experience different types of financial problems and hardships so they can’t make their regular monthly payments. If this situation happens to you, you could be at risk of foreclosure.

A short sale, according to credit.com, could be reported as a charge-off, a settlement, a deed-in-lieu of foreclosure or “settled for less than the full amount due” on your credit report. Any late payments on your mortgage that preceded the short sale will also have a negative effect on your credit, separate from the damage caused by the short sale alone.

A foreclosure, however, can stay on your credit report for up to 7 years according to Experian. This means you will have difficulty getting approved for anything credit based for some time.

(If you’re not too familiar with the entire foreclosure process, we wrote a detailed article on what happens when your house is in foreclosure, which we recommend you check out also.)

This means that you’ll find it hard to get a loan to purchase a home for up to 7 years if you go through the full foreclosure process. Most lenders will most likely decline your loan application for credit cards, cars, houses, and sometimes even apartment rentals or jobs. Obviously, a foreclosure is something that should be avoided at any cost.

This is why many people consider a short sale to keep their credit from getting completely scarred by a foreclosure. Missing a few payments on your mortgage and completing a short sale may have an impact on your credit, and will still do some damage to your credit, but it’s far better than a full foreclosure marking on your credit report.

When Does a Short Sale Make Sense?

In most foreclosure cases, a short sale can be a great way out of your situation. However, there are 2 common scenarios that most people run into:

Financial or Personal Hardship

This is the most common reason short sales are considered. Maybe you’re falling behind on payments and just need to reduce the price of your home to sell it fast and get cash as soon as possible. One way or another, you can take advantage of a short sale to prevent a foreclosure from happening. Banks are not in the business of real estate, they are in the lending business, and do not want to manage your property. This is why in many cases they will accept a discount on what you owe them in order to free up the property to be purchased at a fair market value.

A few common examples of hardships are:

- Death of a spouse or relative

- Lost job or transfer

- Unemployment or reduced income

- Divorce

- Medical emergency or hardships

- Bankruptcy

You Owe More Than the House is Worth

In many housing markets, the values of homes in your area may drop lower than the mortgage you took out. Not good! When this happens you are what people commonly call “underwater”.

This basically means if you tried to sell your house, you would lose money or worse, owe more money than you would get from the sale back to your bank. If you’re in this situation, a short sale can be a great option to reduce the mortgage amount you owe so you can break even and get out.

Since there is not enough equity in the home to pay off the mortgage after sale of the home, the bank will consider a discount of the total loan for it to be able to sell.

The Short Sale Process

A short sale and traditional home selling/buying process have many things in common. The main difference is the homeowner has to get a lender’s approval first for a discount on the original loan in order to be able to take advantage of a short sale. It’s also important to note that it takes more time for a buyer to purchase a short sale property, but we’ll cover that more in detail later.

We understand, sometimes things don’t go as planned. You bought your home, expected to pay everything on time, but life got in the way and now you’re underwater. If you find yourself in the situation when you need to sell your house for less than you owed on the property to the bank, this is when a short sale makes the most sense.

In short, when you’re behind on payments and show probable cause that you may not be able to pay back your loan and meet your original obligation, your lender may agree to forgive the difference on the loan from what the house is currently worth in order for you to sell the property. If the bank accepts the discount, you’ll be able to sell the house for less than you owe and avoid foreclosure.

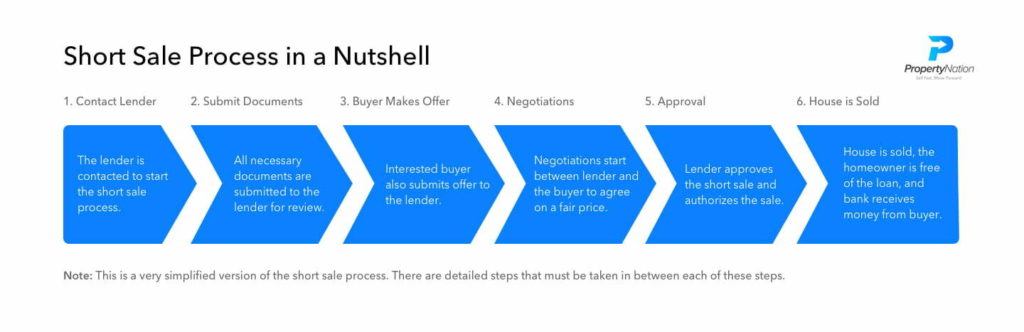

Here is the Short Sale Process in a nutshell:

- Contact the lender – In this first step, the lender is contacted and a short sale request is made. This is typically done by the Realtor & Attorney acting on your behalf. When the short sale request is made the lender (your bank) will then discuss your options with you to determine whether a short sale is truly the best option or not. In some cases, they may lower your monthly payments or provide other options.

- Submit Documents – If a short sale is the best option, the bank will request documents. Every bank has its own requirements but these will include financial documents and other required paperwork from the bank. Again, in most cases, your attorney or the company acting on your behalf will work with you to get these completed properly and submitted to the bank in a timely manner.Here are documents typically required by a bank:

- Letter of authorization, which lets your agent speak to the bank.

- Seller’s hardship letter – Stating why you are requesting a short sale

- Completed financial statement

- Payroll stubs

- 2 months of recent bank statements

- 2 years of your tax returns

- 2 years of W-2s

- Preliminary closing statement

- Comparative market analysis – A list of recent houses that sold in your area provided by a Realtor

- Buyer Makes an Offer – In order for the short sale to be completed, there must be someone ready to purchase the home. The real estate agent handling the short sale will list the home and will need to submit multiple offers to the bank for approval. If the Realtor is working with a real estate investor or investment company like Property Nation, they will make a cash offer to the bank with the Realtor to speed up the process.

- Negotiations – This is where the bank, the Realtor, and your buyer will negotiate a fair offer for the property. This part can take the longest, especially if you don’t have a serious buyer. The bank will assign a Negotiator to your file and request a BPO (Brokers Price Opinion), which is fancy talk for sending an appraiser to the house to assess damages, repairs needed, and overall value of the home in its current condition. Once the BPO arrives to the lender, they will then determine what they will accept as a price to sell the home.

- Approval – Once the bank agrees to the offer from the buyer, they will give the final approval to move to closing. They will provide a written short sale approval letter for the discounted sale of the home and a date for when to close.

- House is Sold – In the last step in the process, the closing takes place, and the house is sold. The homeowner no longer is responsible for the loan, and the new buyer takes over ownership of the house. Note: When the house is sold at a discount, the homeowner may not be 100% free and clear. In some cases, the homeowner may still owe taxes for the difference that was discounted. See below on taxes section for more details.

That’s the entire short sale process in a nutshell. Keep in mind, this is super simplified for illustration purposes but there are steps within each step that must be completed.

How Everyone Benefits from the Short Sale Process

It’s worth noting that the short sale process has many great benefits for home buyers, home sellers, and even lenders. Now, it’s time for you to figure out how you can benefit from the short sale process.

The Homeowner / Seller

Obviously, a short sale is beneficial for a homeowner to get out of a tough situation such as foreclosure. As it was mentioned earlier, a short sale gives a seller an opportunity to avoid foreclosure that results in lowering a borrower’s credit score for up to 7 years.

Another big advantage is that you the homeowner may not have to pay the difference on the loan if a lender allows him/her to benefit from a short sale. Therefore, it would be easier for you to get rid of the loan debt entirely.

Important: The lender MAY forgive your remaining loan balance or seek a deficiency judgment against you (if allowed by state law), requiring you to repay the difference between the sale and the loan balance.

Again, every bank and lender is different so this is only a maybe, as opposed to a foreclosure which is guaranteed if you don’t pay your loan at all.

The Lender/Bank

Believe it or not, a lender can also benefit from a short sale. Even though they are discounting the amount owed and losing money, the reality is it takes a lender too much time to deal with a foreclosure.

Your bank is also not in the business of real estate, they are in the business of lending money. If the house goes into foreclosure they have to take ownership of the home and deal with taxes, fees, vandals, squatters, and local fines for the house not being kept up to date, mowed lawns, etc.

There are many costs associated with the foreclosure process the bank doesn’t want to deal with. That’s why lenders often agree to a short sale. It saves them a ton of time and money.

The Buyer

And of course, a buyer can benefit from a short sale. It’s important to know that short sale properties are usually sold at low prices. This gives a buyer a good chance to buy the home at a great price.

If the buyer is an investor they can also purchase the home as-is and fix it up to resell it for profit or to rent it out for monthly income.

Short Sale Frequently Asked Questions

Can You Short Sale Your Home Before Your Behind on Your Mortgage Payments?

The short answer is yes, it’s possible. Even if you’re not behind on payments yet you can still contact your lender about doing a short sale on your home. The main issue is whether your lender will be open to doing the short sale.

From the banks perspective, why would they discount your loan if it is being paid on time every month? You will need to show probable cause that you are going through financial difficulty and may be falling behind soon in the near future.

Again, this doesn’t mean it’s not possible, we have seen many homes go through the short sale process without the owner falling behind on payments. If you feel you will fall behind on payments and are starting to face financial hardship we recommend reaching out anyways ahead of time.

Will You Owe Taxes After a Short Sale?

As of 2013, any amount that was forgiven by your lender will be considered taxable income under the federal tax laws. In short, this means yes, you will likely owe taxes on the differences credited for the short sale. However, there are certain situations where you will not if there were no capital gains.

In a recent update from Turbo Tax on short sale tax, they stated:

Similar to a foreclosure, any debt that your mortgage lender cancels because of a short sale is taxable only if the terms of your mortgage hold you personally liable for the full amount of the loan. Regardless of the tax consequences, your lender will report the debt cancellation on a 1099-C form.

For example, if you owe $500,000 to your mortgage lender and short sale the home for $450,000, your lender will report $50,000 of canceled debt on your 1099-C. Since most mortgage lenders wouldn’t agree to a short sale if the value of the home exceeds the outstanding mortgage balance, no capital gains issues exist.

There are other cases when you will not owe taxes, these include:

- Bankruptcy – If you filed and completed bankruptcy and the debt was discharged after bankruptcy then it may not be considered taxable income.

- Insolvency – If your total debt owed is more than the fair market value of your total assets this is considered “insolvent”. In this situation, the debt you owe can be canceled and the forgiven amount may not be taxable.

Note: This is not legal or financial advice, please seek the counsel of a real estate attorney. We can also connect you with a trusted attorney if you’re not sure where to look. Contact us if any questions.

Should You List With a Realtor?

Yes. Legally, when doing a short sale, there is no other option but to list the property with a Realtor. (This is why we work with our team of real estate agents that specialize in Short Sales.)

A real estate agent can put your property for sale, advertise it effectively and finally help you find a buyer. The Realtor will also cooperate with the attorney for the short sale to see it through.

A real estate attorney will assist the agent with the legal aspects of the short sale process and provide what the Realtor what they need as well.

Commission & Fees

Unlike a traditional selling process where you would pay the Realtor commission, during a short sale the homeowner does not have to pay the commission because it is already included in the short sale approval from the bank.

If a person or company tries to get you to sell your house as a short sale without a Realtor, chances are they could be doing things illegally and should be avoided.

Remember this is a touchy process with lots of legal matters to consider so we always recommend getting guidance from experts or an attorney well versed in the short sale process.

We have a team of Realtors and attorneys we work with specifically for this process ready to help you.

How Long Does a Short Sale Take?

Some short sales can get approval in 2 to 8 weeks. Others can take 90 to 120 days, on average. The length of the short sale generally depends on the buyer, not the bank.

This is why it’s so important to work with a real buyer who is 100% serious about purchasing your home.

If the buyer is serious about purchasing the home and paying cash, you will typically see a faster short sale process.

Should You Sell to a Real Estate Company?

Most buyers get annoyed because the short sale process can take so long. So they often cancel their offer without telling anyone, including the agent.

This then resets the negotiation process, prolonging the short sale.

This is why working with a serious cash buyer is crucial. Instead of a flaky buyer that may back out after weeks or months of negotiating, you have a real buyer in place, speeding up the entire process and keeping you from more months of late payments on your credit.

Let’s talk about the most important advantages of selling a house in foreclosure to an investment company:

Faster Process – As investors, we operate very fast and provide the bank with a cash offer within 24 – 48 hours. So, it will not take long for your bank to make a decision. If they like the cash offer, then they’ll be able to start the short sale process right away. We also work directly with the Realtor as the buyer to speed up the process.

Cash is King – During a short sale, cash is king. While it’s possible to complete a short sale with a buyer that has a loan, it is much more difficult. The buyer’s bank will require the house to meet certain requirements and pass an appraisal which won’t happen if your house needs a lot of repairs. Especially if you don’t have the money to make those repairs. With an investment company like us, the bank will get paid quicker, so this speeds up the approval of the short sale, and you’ll be able to pay off your loan once the offer is accepted by the bank.

No Repairs – You’ll definitely find it hard to sell a property that needs to be repaired during a short sale if you go the traditional route. Buyers usually go away if they find that a property has lots of problems. On the other hand, it’s easy to sell a property that needs repairs to a real estate investor, in fact, we love properties that need repairs. Since we purchase properties in any condition, you or the bank won’t have to put any money into repairing the property, and you won’t have to find a buyer that wants the property in perfect condition.

Foreclosure Scams to Avoid

Selling a home in foreclosure is no easy task. Here are a few tips to help ensure it goes as smoothly as possible and you avoid foreclosure scams.

Have patience – Keep in mind that you must be prepared to wait if you would like to sell a short sale property. While most lenders have a refined process for dealing with short sales, to may take you a long time to get the banks approval in some cases. The short sale process can take anywhere from 2 to 6 months. In some cases, as much as a year.

Find the right help – Oftentimes, the success of a home buyer depends a lot on a realtor, attorney, or investment company acting on your behalf. Dealing with the right team increases your chance to complete the short sale process. So, it would be better for you to find a realtor who specializes in short sale properties if you choose to use a Realtor, or to work with an investment company like Property Nation who has an entire team ready to help you and buy the property all in one place.

Beware of fake offers – Make sure to avoid foreclosure scams by mail. It is common that as soon as you start to enter into foreclosure you will be contacted by multiple people by phone or mail pretending to be your mortgage company or lender. These are just scams trying to trick you into sending payments to them instead. Always make sure you check where the letter is truly from, and never send money to anyone.

Don’t pay for foreclosure help – If a company is asking you to pay them to get you out of foreclosure or to provide a loan modification, this usually screams a scam. Charging a fee for a loan modification in advance is illegal in most cases and most of these companies are trying to scam you out of your hard-earned money.

Don’t Sit and Wait, Things Could Get Worse

Remember, a solution exists! And of course, you should do your best to stop a foreclosure. In other words, if you are behind your mortgage payments and find that you can’t resolve your financial problems within a short period of time, then you need to contact your lender as soon as possible. Remember, things will get even worse if you delay the process!

As it was mentioned above, foreclosures are bad for everyone involved. In fact, lenders don’t like to deal with the foreclosure process and usually do everything possible to help their customers. So, a lender will probably allow you to benefit from a short sale.

Among the other options to avoid foreclosure are: loan modifications, loan forbearance and so on. The only way to determine what’s best for you is to reach out to experts for help and don’t delay taking action.

Next Steps and Working With the Right Team

To get started, first of all, you need to make an attempt to get the short sale approval from a lender. As discussed in this article, you will need a Realtor, an Attorney, and a Buyer to make it all happen. Rather than searching for all of these individually, you can get it all right here at Property Nation.

We have expert Realtors and Attorneys we work with for Short Sales, and we are the buyer.

You should know that it will take a lender some time to review your short sale approval letter. So, the sooner you contact a lender to obtain permission for a short sale – the better. Again, we recommend having a team on your side to help you through the process.

If your lender agrees to a short sale, then you need to do everything you can to sell your property in foreclosure as quickly as possible. Bear in mind that selling a house through a short sale is no easy task that requires some knowledge, skills, preparation and, of course, experience. That’s why it’s important to work with the right company to get it done right. We have attorneys and a team of resources to help facilitate the entire process from start to finish for you.

Don’t take our word for it though, see our reviews of people we have helped through the short sale process.

If your home is currently in foreclosure and you’re considering a short sale, please contact us today. We’ll keep your situation confidential and walk you through the entire short sale process. We never charge you any fees, and there are no obligations or commitments.

Related Articles:

Short Sale Process for Sellers

How Does a Short Sale Affect Your Credit Score?

How to Get More from Selling Your Miami Home

Why Selling to Home Investors is Ideal

10 Differences Between Listing vs Selling to Investor